Queen's Financial Operating Framework

The emerging landscape for Queen’s and the wider Higher Education sector is evolving at an unprecedented rate. Immediate change is needed to support the financial sustainability of the University both now, and for years to come. The implementation of a new Financial Operating Framework and ways of working will support Queen’s to address these challenges.

The Framework supports the University to manage key risks, such as:

- Challenges in its ability to remain financially sustainable

- The ability to meet its planned budget position

- The ability to invest in the future in line with its ambitious plans

- Resilience to financial shocks and wider economic challenges

The Framework will enable increased transparency, accountability and ownership of financial performance across Queen’s, including delivery of Institutional Strategies, while enhancing financial performance and governance.

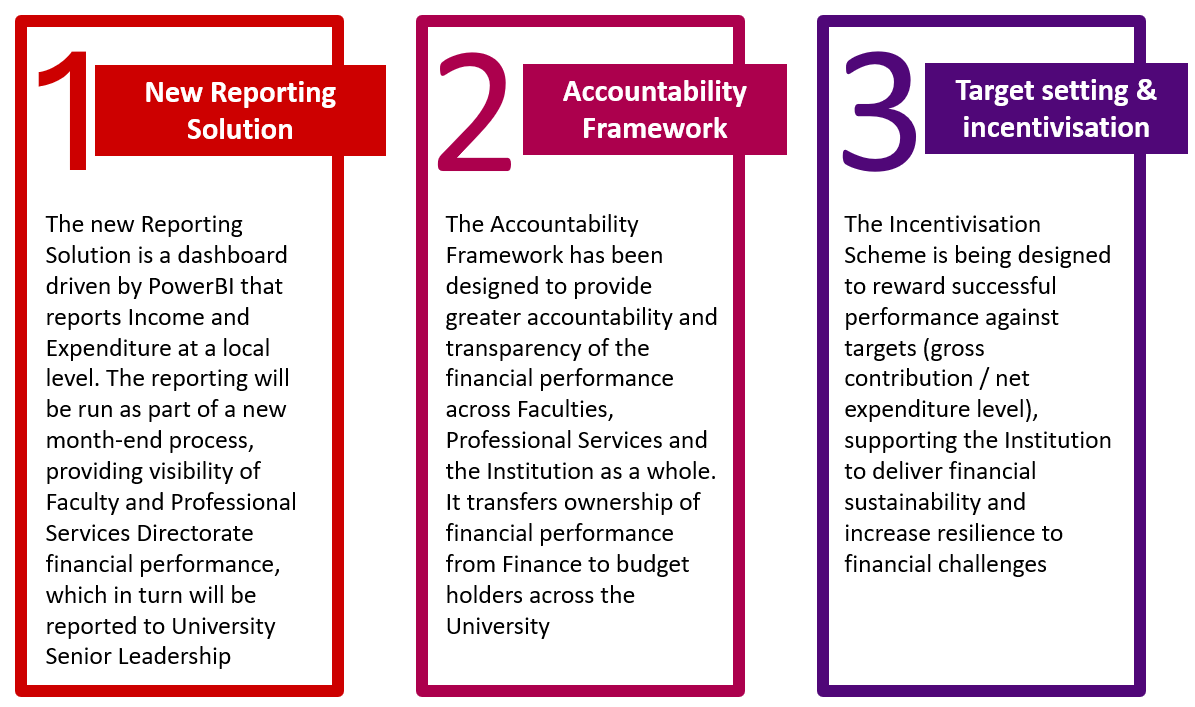

The Financial Operating Framework consists of three components.

A brief overview of the Financial Operating Framework can be found on the video below.

-

Reporting Solution

The Reporting Solution provides greater visibility and understanding of income, costs and financial performance across the University.

The monthly financial reports are a key tool for Professional Services and Faculties to communicate their financial position, mitigate risk and support a shift in mindset to increase strategic and commercial decision making.

Users of the Reporting Solution within Faculties and Professional Services comment on the financial performance of their respective areas, providing explanations for any discrepancies. This feeds into reporting to Senior Leadership within the University.

The monthly financial reports are in Power BI and the following key principles are in place:

- Consistency - Standardising reporting processes across the whole institution

- Accuracy - One version of the truth throughout the institution

- Efficiency - Utilising the Power BI solution to automate and reduce manual activities

- Relevance - Focusing conversations on key drivers

- Strategic decision-making - Helping to add value and drive strategic decision-making

The Reporting Solution allows the University to view income and expenditure at a local level. This enables the University to have greater visibility and understanding of gross contribution / net expenditure at a local level.

The Reporting Solution will support improved financial performance and governance:

- Enhances the visibility and transparency of financial information across the University, and at a Faculty and Professional Services level

- Provides a comprehensive view of income and expenditure, with the ability to drill down into cost and income categories

- Users can navigate the Reporting Solution to examine financial data in detail

- Key stakeholders will be able to utilise the Reporting Solution to prepare a monthly financial report

- Facilitates a comparative analysis of actual financial performance against forecasted budgets, enabling informed decision-making and strategic financial management

The Reporting Solution is used to support all financial reporting at Queen's.

- The Accountability Framework

The Accountability Framework is designed to provide greater accountability, transparency and visibility of the financial performance across Faculties, Professional Services and the University as a whole.

Accountable officers are responsible for delivering a planned gross contribution / net expenditure for their area. If there are any variances to these agreed plans the accountable officer explains these to the University's Senior Leadership, along with planned mitigating actions.

Principles of the Accountability Framework:

- Faculty PVCs are accountable for the delivery of an agreed contribution of each faculty

- Professional Services VPs and PVC (R&I) are accountable for the delivery of an agreed net expenditure / contribution

- The financial performance of all Faculties and Professional Services areas is reported to Senior Leadership including UMB, PFC and Senate

- UMB is accountable for the ultimate consolidated financial position of the University

- Faculties and Professional Services have greater flexibility to manage resources in a more agile way. Decisions will be made on an affordability basis and Faculties and Professional Services consider and review interdependencies.

- Target setting & Incentivisation

The Incentivisation Framework is being designed during 2024-25. It will incentivise financial performance of Faculties and Professional Services Directorates where gross contribution targets have been exceeded, and net expenditure targets have not been exceeded.

During 2024/25, further work will be undertaken by the University to refine and agree future targets as a key element of institutional integrated planning. Once this has been completed, these targets will be communicated to key stakeholders and more broadly. The principles of target setting and incentivisation have been agreed, and are set out below:

Principles of target setting and incentivisation are:

- Reward successful performance against targets, to deliver financial sustainability and increase resilience to financial challenges

- Allow access to additional operating expenditure through incentivisation schemes, to allow for greater transparency and autonomy of investment programmes

- Provide a holistic approach to incentivisation and target setting

- Support financial planning, management and ownership